Compare and purchase the best business insurance rates in Ontario.

Get free and accurate quotes from Canada’s top insurance providers.

In just a few minutes, our quoter can unlock discounts that can have

you saving hundreds of dollars a year on average.

Own a business in Ontario? Make sure you're covered!

Whether you’re running a home-based business or managing a large company, business insurance is essential. The right coverage helps ensure you’re protected if something unexpected happens, like a fire, theft, customer injury, or equipment failure.

Ontario is home to more than 16 million people and represents the largest economy in Canada. Its central location and access to major transportation routes and waterways make it a hub for industries like manufacturing, food and beverage, and automotive production. Over 400,000 small businesses are registered in Ontario, making it one of the most active provinces for entrepreneurs.

Surex partners with top insurers across Canada to give business owners a real choice in price, coverage, and provider. You’ll also be matched with a dedicated insurance advisor, who will guide you through the process and answer your questions along the way.

Getting a quote doesn't have to be complicated. Our online platform and expert advisors help simplify the process, so you can get a business insurance quote in just a few minutes.

Compare 10+ Quotes +

Speak to a Dedicated Advisor

Licensed Insurance Advisor

Business insurance in Ontario – FAQs

There are several types of business insurance available in Ontario, and the right combination depends on the size, industry, and structure of your business. Here are some of the most common types:

- General liability insurance: Covers situations where someone is injured or their property is damaged because of your business activities. It also helps with legal costs if someone decides to take action against you.

- Professional liability insurance: Also known as errors and omissions (E&O) insurance, this protects you if a client claims your advice, service, or work caused them harm. It’s especially important for service providers, consultants, and freelancers.

- Commercial property insurance: Helps pay for repairs or replacement if your business space or its contents are damaged due to fire, theft, vandalism, or other covered events.

- Business interruption insurance: If something unexpected forces your business to close temporarily, business interruption insurance can help cover lost income and keep your operations afloat until you can reopen safely.

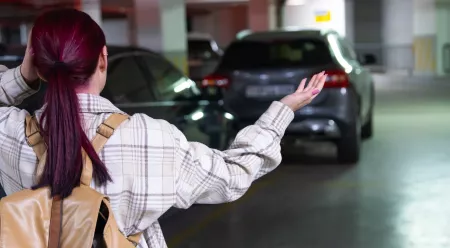

- Commercial auto insurance: If you use a vehicle for work, commercial auto coverage protects you in case of an accident or damage while using that vehicle for business purposes. Personal auto insurance does not usually cover business use.

- Workers’ compensation insurance: If an employee is injured on the job, this coverage helps with medical expenses and lost wages. In Ontario, many employers are required to register with the Workplace Safety and Insurance Board (WSIB).

Other optional types of coverage include cyber insurance, product liability, and directors and officers insurance. A Surex advisor can help you decide which types are right for your business based on your industry, size, and day-to-day operations.

Business insurance is not legally required for all businesses in Ontario, but certain types of coverage may be mandatory depending on your industry, operations, or contractual obligations. For example:

- Workers' compensation coverage through the Workplace Safety and Insurance Board (WSIB) is mandatory for many types of businesses with employees.

- If your business owns and operates vehicles, commercial auto insurance is legally required in Canada.

- Some professions, such as lawyers or healthcare providers, may be required by law, clients, or regulators to carry errors and omissions (E&O) insurance.

Although business insurance isn’t mandatory in Ontario, it’s highly recommended. It can help protect your operations, assets, and reputation from unexpected risks like property damage, lawsuits, theft, or data breaches. Without coverage, a single incident could lead to significant financial loss.

Insuring a home-based business in Ontario typically requires a specific add-on to, or separate policy from, your existing home insurance. Standard home insurance typically doesn’t cover business-related activities, equipment, or liability, which can leave you exposed if something goes wrong. Depending on the size and scope of your business, you may need:

- A home-based business endorsement added to your home insurance for basic protection

- A standalone commercial insurance policy for broader coverage

- Specialized coverage, such as cyber liability if you handle sensitive data or errors and omissions if your business provides services or advice

Every home-based business is different, which is why it helps to chat with a licensed insurance advisor. They can walk you through your options and help you find coverage that best fits your situation.

Recent customer reviews

Find out why Canadians trust Surex for their insurance needs.

Surex insurance tips & advice

Car accidents are stressful and costly—stay calm, protect safety, and know your rights. Common causes include distraction, impairment, fatigue, poor maintenance, and bad weather.

In Canada, any car can be stolen, but certain models are targeted more—learn which vehicles top the most-stolen list to help protect your investment.

Auto thefts in Canada fell 19.1% in early 2025, but experts caution this may not immediately lower car insurance rates due to complex factors.